Mileage Reimbursement Template

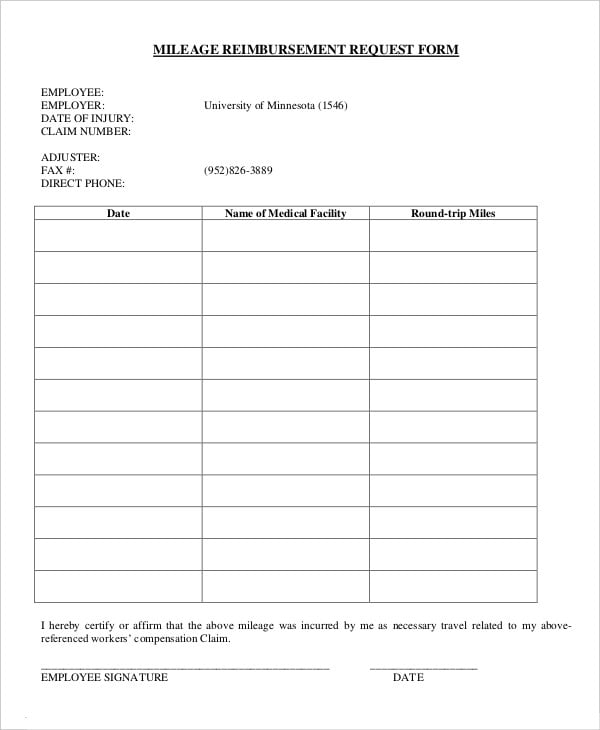

Also predetermine the distance by allowing only the most. It also presents details like the name and address of the physician date claimants starting and ending destination address and round trip miles.

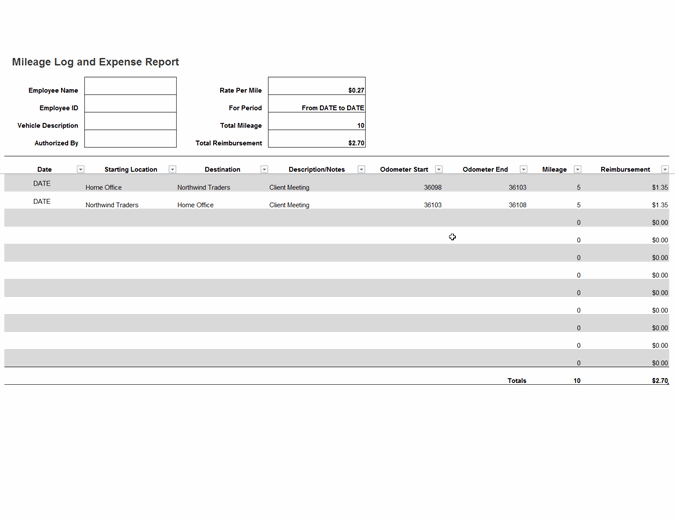

Mileage Log And Expense Report

To further expand this mileage reimbursement form consider adding.

. PdfFiller allows users to edit sign fill and share their all type of documents online. Save time and resources when preparing delivering and signing documents. Discover High Quality Mileage Log Template at TidyForm.

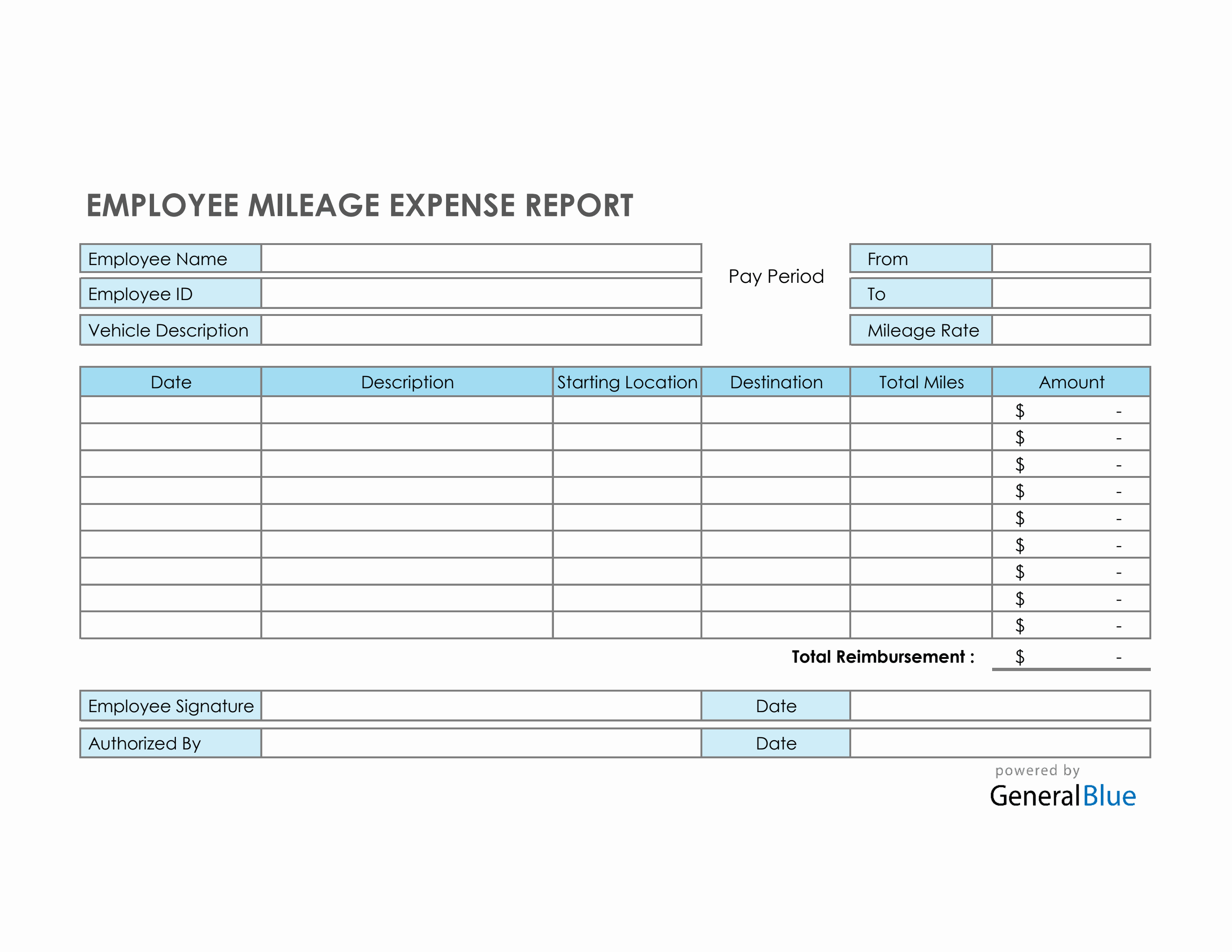

The template for this particular form has a huge demand in the market. A mileage reimbursement form is a category of a form which gives a detailed record of the travel cost that an individual has incurred over time. The Internal Revenue Service IRS 2022 business mileage standard rate is 585 cents up 25 cents from the rate for 2021.

This mileage reimbursement form presents the claim number employee and employer names and date of the accident. Destinations that are often reimbursable include conventions client visits work-specific errands to-and-from airports for business travel driving to take clients to dinnerslunches and non. Get work done faster.

You can customize this template to fit your businesss branding and share it in lots of waysembed it into an email ping the link directly to employees or embed it into your. Ad Download or Email Mileage Log More Fillable Forms Register and Subscribe Now. When the federal mileage rate is 56 cents per mile multiply this rate by the number of miles the employee drove for a period of time.

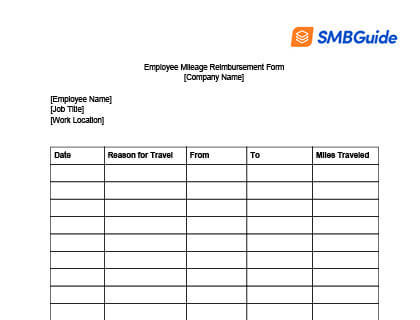

Engine size registration plate and. On this template weve included the following. Some of these employees include delivery drivers or rideshare freelancers real estate agents service workers and many more mainly self.

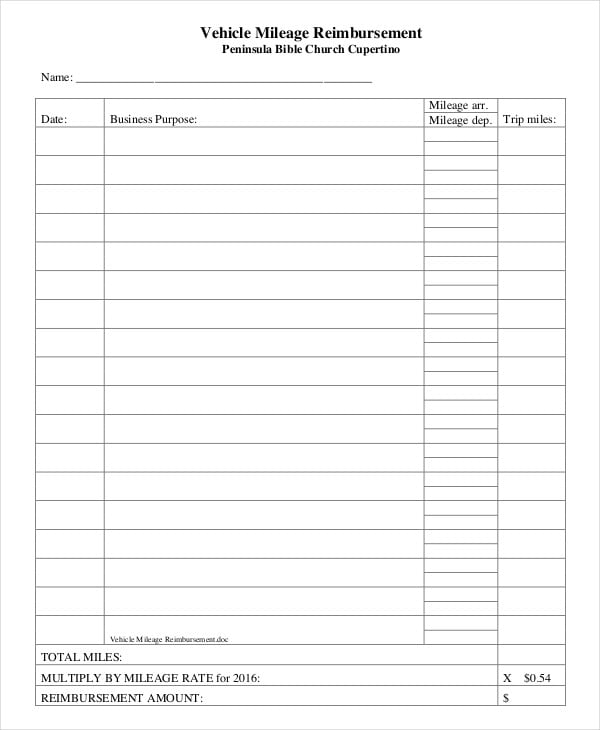

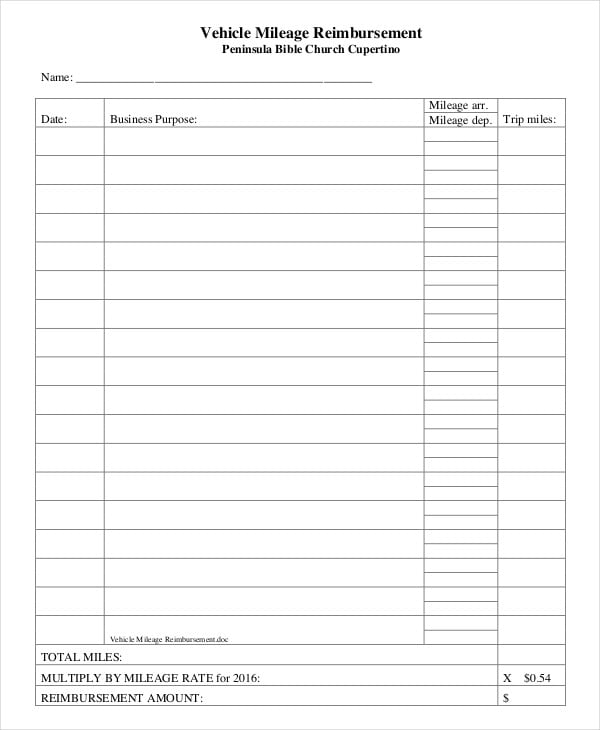

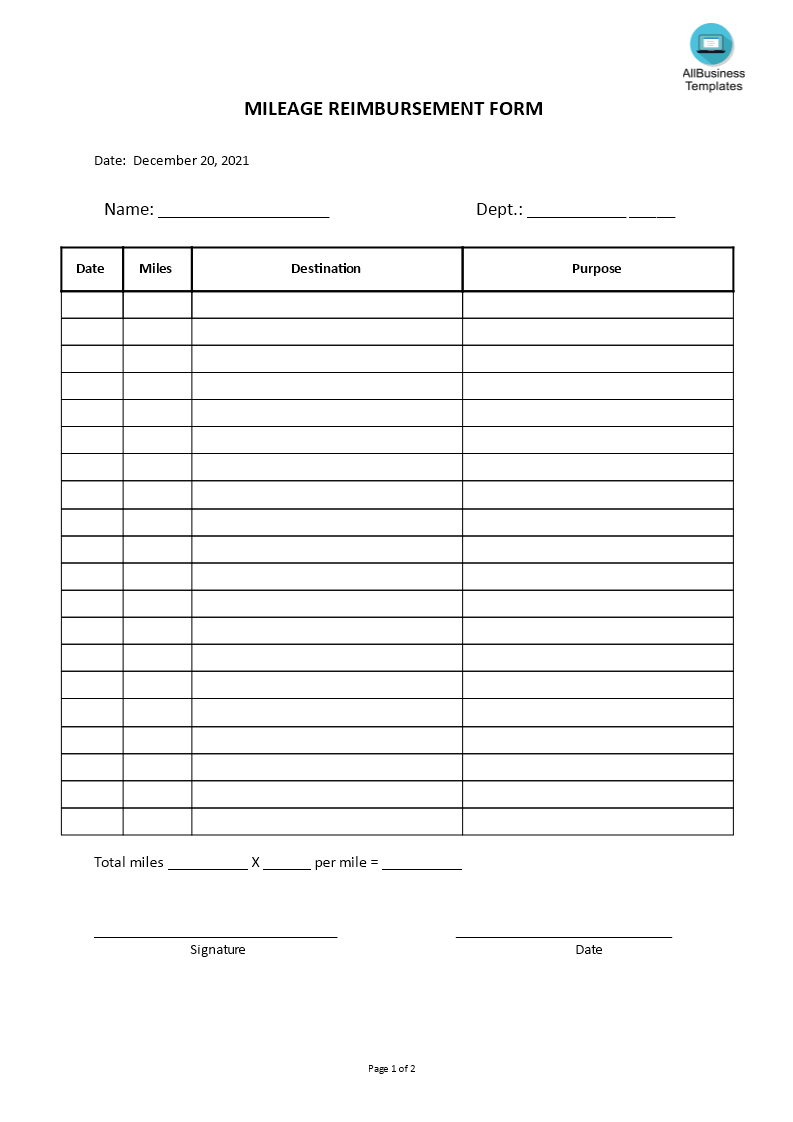

Create a standard mileage reimbursement form for your employees to fill out when claiming their business miles expenses. Each of these templates can be printed out or. Details regarding the journey.

Ad Download Mileage Log Template Now. This applies to miles driven between January 1 and June 30 2022 because following a mid-year adjustment the federal business mileage rate is 625 cents from July 1 2022 to December 31 2022. When an employee is temporarily reassigned to a different work location mileage will be reimbursed in excess of the normal mileage between the employee s home and the regular work location.

What to Include in Your Mileage Reimbursement Policy. Mileage Reimbursement and Tracking Log. A receipt file upload field.

A mileage reimbursement invoice is given by a business or charity employee to their employer for the purpose of collecting compensation for the miles driven to a location required for work. Your mileage reimbursement policy must define which expenses will be reimbursed and under which. Why should I use a mileage reimbursement form.

Except where indicated below the Court does not reimburse workers for home to work. This mileage claim form can be used by employees to request for reimbursement for mileage expenses from your company. Sample 1 Sample 2.

IRS Mileage Reimbursement Form and Tracking Templates Mileage reimbursement form is a document used by employees seeking reimbursement for using their personal vehicles to conduct official business. Mileage Log For Taxes. DOWNLOAD FREE MILEAGE REIMBURSEMENT TEMPLATE.

A declaration confirming the information is correct. Employees can simply download a mileage log template in any format that is preferred that is PDF MS Excel or MS Word. Ad Create and fill out forms easier with a no-code automation solution.

This typeform makes it easier for employees to log their business mileage thanks to its simple yet beautiful design. Printable Business Mileage Log Sheet. Heres an example for when the standard rates are applied.

That way all your claims will be filed in a uniform manner. If the employee drove 100 miles in July the reimbursement would be 56 and so on. Before we go here are a couple of useful mileage reimbursement policy templates to help you formulate your own document.

Its helpful to employees whose transport expenses are covered by their employer as it accurately calculates mileage expenses on a specific period. However to reap all these benefits you need a solid mileage reimbursement policy for employees to establish the most effective practices. The form keeps a running tally and auto-calculates the amount that needs to get reimbursed in accordance with the mileage rate.

Print or download this free mileage tracker template anytime.

Free 11 Sample Mileage Reimbursement Forms In Ms Word Pdf Excel

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Mileage Form Templates At Allbusinesstemplates Com

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement Form In Pdf Basic

Mileage Reimbursement Form Template

Comments

Post a Comment